STAIRS Weekly Report

21 Sep 2023

Disclaimer & Disclosures

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Name of the Research Analyst as registered with SEBI | Weekendinvesting Analytics P Ltd |

Registered office address | B- 6/102, SAFDARJUNG ENCLAVE, NEW DELHI South West Delhi, Delhi, 110029 |

Contact Number | 7011702875 |

SEBI Registration No | INH100008717 |

Brand name | WeekendInvesting |

Name, telephone number and Email address of Research Analyst | Name : Alok JainPh no : 7011702875 Email Address : alok@weekendinvesting.com |

Note : Nifty EXP, Options AIT, Options BUY & Futures models went live on 01 Apr 2022 while Finnifty EXP, STAIRS EXP HR and STAIRS EXP LR went live on 01 Apr 2023. The data prior to that date has been put up as a study material to understand the prior period analysis.

Nifty Weekly Range

After touching 20200, Nifty saw two consecutive sessions of gap down followed by intra day drop indicating clear weakness in the short term. While consolidation is certainly healthy during long term uptrends, the last two sessions may be indicative of not so great times for the markets in the shorter timeframes while we are still placed quite comfortably in the longer timeframe based charts.

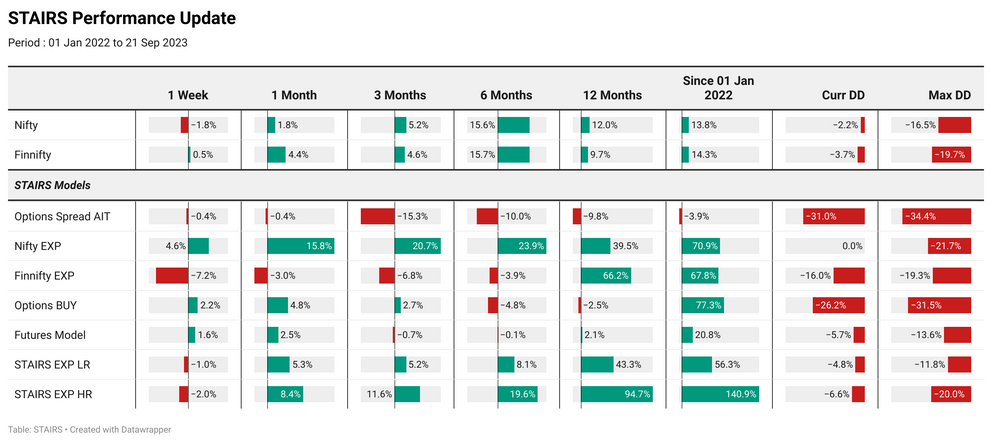

Performance Update

A mixed week for STAIRS but a great trend on either sides is always good news especially for a trend following system like ours. Finnifty EXP was unfortunately caught on the wrong side of the trend but Nifty EXP was swift enough to capitalize on the SHORT trade to successfully establish a new ATH recovering from all drawdowns. Futures model also had a solid couple of trades to reduce the deficit by a reasonable margin. It would mean great business for STAIRS models if we continue to get one sided trends like we have seen in the last few sessions.

We introduced FINNIFTY expiry as well which went LIVE from first week of April'23. You can have a look at the intro video here

General Note : As drawdowns increase, we will witness an aggressive reduction in position sizing in all options models. The recovery may be slow but profit / capital protection is at the core of the strategy. Kindly come in with a mindset to stay invested in the strategies at least for a period of 18 months to be able to make the best out of STAIRS models.

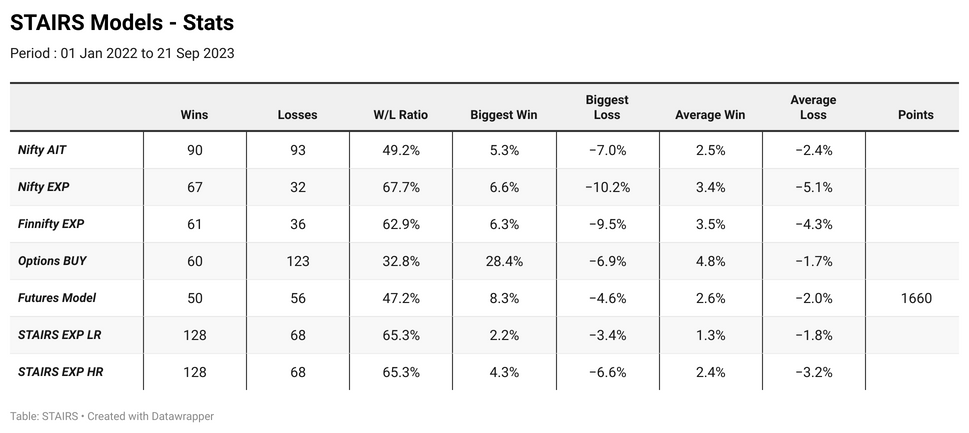

Model Trade Stats

You may subscribe to STAIRS using any of the following plans.

- Annual plan at INR 18,000 + GST (INR 21,240)

- Quarterly Trial plan at INR 6,000 + GST (INR 7,080)

- Monthly Kickstarter Plan at INR 2500 + GST (INR 2,950)

Performance Charts

Performance Charts

Performance Charts

Performance Charts

Performance Charts

Performance Charts

Performance Charts

Introduction to STAIRS Models

You can have a look at the historical performance charts of all STAIRS models using the link below

You may Subscribe to STAIRS using the link below

Please send an email to support@weekendinvesting.com if you have any queries regarding the models or subscription

That's all for this week !